IRS Audit, IRS Audit Process, IRS Tax Problems

Death and Taxes – Part Two – Do I have to pay taxes after I die

July 11, 2013 - IRS Audit, IRS Audit Process, IRS Tax Problems

Do I have to pay taxes after I die? I thought taxes would end when I did!

While we are earning money, we get a W2 or a 1099 and we pay INCOME TAX.

When we have investments that pay us interest income or dividend income or we sell an investment for a profit and have a capital gain we pay INCOME TAX. When we are retired and receiving retirement benefits we may pay INCOME TAX.

And you are saying…we might have to pay taxes even after we die?

If you leave too much money behind when you leave this earth, you may be subject to ESTATE TAX.

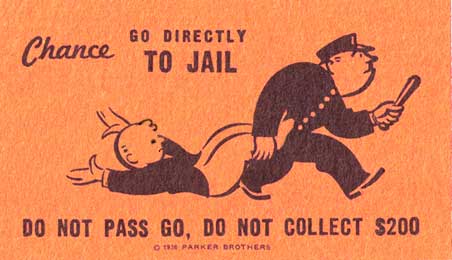

“But I have a will. Doesn’t that make a difference?” A will is a legal document that determines how your assets are distributed after your death. Do you remember the board game Monopoly? “Go to Jail. Go directly to Jail. Do not pass Go. Do not collect $200.” Well, with a will you “Go to Probate. Go Directly to Probate… “

What is probate?

According to Wikipedia, a probate court decides the validity of a will and grants its approval to the executor The executor is the person charged with having the legal power to dispose of your assets in the manner specified in the will.

The court wants to make sure your wishes are followed. And probate takes time – sometimes a lot of time and it can take money for legal fees. Creditors need to be notified and given time to present their claims. Legal notices will be published.

As many as 55% of Americans die without a will. Making no decision is still a decision. Families are supposed to love one another, but things can get ugly very quickly when MONEY is involved.

According to Morning Star.com, “If you don’t [have a will], the state will decide how your assets are distributed, and even who will be the guardian of your minor children. And once you have a will, it’s important to make sure it’s clear and up to date.”

Why do I want to think about a trust? What can a trust offer me that a will cannot?

Elvis Presley died with a valid will in place in 1988. His estate was valued at over $10 million. The probate process fees and taxes cost over $7 million! His family would have received much more if he had had a trust instead of just a will.

A trust is private, you avoid probate. While a will can be contested in court, it is much harder to challenge a trust.

Taxes do not always have to be paid at a death. But like anything else in life, it is better to have knowledge in advance so if you have a choice, you can make an informed decision.