Did you know the Internal Revenue Service can ask to see your bank statements? It is important for you to understand why.

…

Having a business is a little like having a child. Both the child and the business are a part of you, but they are also separate from you.

…

Are you a business owner? No matter how small a business, if you are in business, your business needs its own bank account.

…

You will deposit every penny,

EVERY penny your business earns into that business bank account. You may want to have both a business checking account and a business savings account. When you have more money than you need to cover expenses, you can transfer that beautiful excess into your savings account.

…

When you deposit your business proceeds into your bank account, it should be easy to match those deposits to your sales records. In the accounting world, that is known as “tying” the deposits to the sales records.

…

When you transfer money from one account to the other, it is important to make a note to remind you that this is not new money being deposited. It is a TRANSFER from checking to savings or vice-versa.

…

In the beginning of your business you may “seed” your account with your personal money. This is not business income. This is your investment in your own business. You may have other people invest in your business. If you give them shares of your business stock in return for their money, they are now a stockholder in your business. You want to be sure to record (make a note of) that transaction.

…

There may come a time when you need to borrow money. When you take out a business loan to help fund your operations, the money you owe becomes a liability on your balance sheet. This blog post is not about accounting, it is about your bank statements. The loan you receive is not income from the sale of your products or services. The loan is not taxable income. You want to make sure you are protecting yourself by making adequate notes about what money is going into your bank accounts.

…

When the IRS examines a business tax return, they often ask to see the bank statements. They want to know how much money is going into your bank accounts. They will examine your income records and match them to your bank activity. If you cannot prove that extra $10,000 was a loan from Aunt Mary, then that $10,000 could become taxable income in the eyes of the IRS Agent. And if you are in the 15% tax bracket, a $10,000 adjustment to your return could cost you $1500! You don’t owe tax on the loan. Documentation is your protection.

…

Remember, as an American, you are taxed on your WORLDWIDE income. Wages, business profits, interest income and dividends from stocks and bonds are just some of the types of taxable income. Transfers between accounts, loans, and gifts are generally not taxable.

…

I just want you to have the information you need to protect yourself when it comes to your taxes.

Attention Employees: This is the blog I promised you.

.

You are required to attach your W2 to your tax return when you file this important once-a-year tax form. Every year you have the chance to “look yourself in the eye” and sign your tax return under penalty of perjury that it is correct and accurate.

..

If you don’t already have your W2 for 2013, you should be getting this important form very soon. Employers are required to issue their W2 forms by January 31st.

..

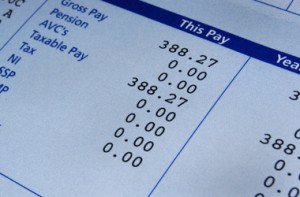

Did you move since you were first employed? Does your employer have your correct current address? Did your employer go out of business during the year? Did they pay their accountant in advance to issue the year-end W2 forms? They probably did not. On payday did you get a paystub showing the cumulative, or year-to-date income earned and taxes withheld? Did you keep track of these numbers yourself? Most people won’t but it is a good idea.

..

Did you have more than one job during the year? Do you have a W2 from EACH of your jobs? You must report your total income from all taxable sources. What can you do if you don’t have this required for filing form?

..

If you have not received your W2 by February 14th, you can call the IRS for assistance. When you dial 1-800-829-1040, be prepared to wait on hold. It could be a long wait. This is a toll-free number and they get a lot of callers.

The assistor at the Internal Revenue Service will ask you for your name, your address with zip code and your social security number. (Remember YOU called them. DO NOT (and I MEAN EVER!) give this confidential information to any one who calls you. Protect your identity.) The IRS will also ask for your employer’s name, complete address, phone number and your dates of employment. IRS will contact your employer for you (if that is possible) and will request the missing form for you.

Form 4852, Substitute for W2, was designed for just this purpose. When you call the IRS to request their help, they will send you this form. There are blanks for

you to fill in your wages and withholdings. It will ask you how you determined the amounts you are entering. It will also ask you to describe what you did to try to obtain your W2.

If you did receive a W2, was it correct? If you think it was not correct, contact your employer and request a corrected one, a W2-C. If you filed your tax return using Form 4852 and then received a W2 or W2-C showing different amounts, then you must file Form 1040X to amend your return. This amendment may result in you owing more tax or it may result in you getting a refund. Consult your tax professional for help filing this more complicated form.

Attention Employees: This is the blog I promised you.

.

You are required to attach your W2 to your tax return when you file this important once-a-year tax form. Every year you have the chance to “look yourself in the eye” and sign your tax return under penalty of perjury that it is correct and accurate.

..

If you don’t already have your W2 for 2013, you should be getting this important form very soon. Employers are required to issue their W2 forms by January 31st.

..

Did you move since you were first employed? Does your employer have your correct current address? Did your employer go out of business during the year? Did they pay their accountant in advance to issue the year-end W2 forms? They probably did not. On payday did you get a paystub showing the cumulative, or year-to-date income earned and taxes withheld? Did you keep track of these numbers yourself? Most people won’t but it is a good idea.

..

Did you have more than one job during the year? Do you have a W2 from EACH of your jobs? You must report your total income from all taxable sources. What can you do if you don’t have this required for filing form?

..

If you have not received your W2 by February 14th, you can call the IRS for assistance. When you dial 1-800-829-1040, be prepared to wait on hold. It could be a long wait. This is a toll-free number and they get a lot of callers.

The assistor at the Internal Revenue Service will ask you for your name, your address with zip code and your social security number. (Remember YOU called them. DO NOT (and I MEAN EVER!) give this confidential information to any one who calls you. Protect your identity.) The IRS will also ask for your employer’s name, complete address, phone number and your dates of employment. IRS will contact your employer for you (if that is possible) and will request the missing form for you.

Form 4852, Substitute for W2, was designed for just this purpose. When you call the IRS to request their help, they will send you this form. There are blanks for

you to fill in your wages and withholdings. It will ask you how you determined the amounts you are entering. It will also ask you to describe what you did to try to obtain your W2.

If you did receive a W2, was it correct? If you think it was not correct, contact your employer and request a corrected one, a W2-C. If you filed your tax return using Form 4852 and then received a W2 or W2-C showing different amounts, then you must file Form 1040X to amend your return. This amendment may result in you owing more tax or it may result in you getting a refund. Consult your tax professional for help filing this more complicated form.  Attention Employees: This is the blog I promised you.

.

You are required to attach your W2 to your tax return when you file this important once-a-year tax form. Every year you have the chance to “look yourself in the eye” and sign your tax return under penalty of perjury that it is correct and accurate.

..

If you don’t already have your W2 for 2013, you should be getting this important form very soon. Employers are required to issue their W2 forms by January 31st.

..

Did you move since you were first employed? Does your employer have your correct current address? Did your employer go out of business during the year? Did they pay their accountant in advance to issue the year-end W2 forms? They probably did not. On payday did you get a paystub showing the cumulative, or year-to-date income earned and taxes withheld? Did you keep track of these numbers yourself? Most people won’t but it is a good idea.

..

Did you have more than one job during the year? Do you have a W2 from EACH of your jobs? You must report your total income from all taxable sources. What can you do if you don’t have this required for filing form?

..

If you have not received your W2 by February 14th, you can call the IRS for assistance. When you dial 1-800-829-1040, be prepared to wait on hold. It could be a long wait. This is a toll-free number and they get a lot of callers.

The assistor at the Internal Revenue Service will ask you for your name, your address with zip code and your social security number. (Remember YOU called them. DO NOT (and I MEAN EVER!) give this confidential information to any one who calls you. Protect your identity.) The IRS will also ask for your employer’s name, complete address, phone number and your dates of employment. IRS will contact your employer for you (if that is possible) and will request the missing form for you.

Form 4852, Substitute for W2, was designed for just this purpose. When you call the IRS to request their help, they will send you this form. There are blanks for

you to fill in your wages and withholdings. It will ask you how you determined the amounts you are entering. It will also ask you to describe what you did to try to obtain your W2.

If you did receive a W2, was it correct? If you think it was not correct, contact your employer and request a corrected one, a W2-C. If you filed your tax return using Form 4852 and then received a W2 or W2-C showing different amounts, then you must file Form 1040X to amend your return. This amendment may result in you owing more tax or it may result in you getting a refund. Consult your tax professional for help filing this more complicated form.

Attention Employees: This is the blog I promised you.

.

You are required to attach your W2 to your tax return when you file this important once-a-year tax form. Every year you have the chance to “look yourself in the eye” and sign your tax return under penalty of perjury that it is correct and accurate.

..

If you don’t already have your W2 for 2013, you should be getting this important form very soon. Employers are required to issue their W2 forms by January 31st.

..

Did you move since you were first employed? Does your employer have your correct current address? Did your employer go out of business during the year? Did they pay their accountant in advance to issue the year-end W2 forms? They probably did not. On payday did you get a paystub showing the cumulative, or year-to-date income earned and taxes withheld? Did you keep track of these numbers yourself? Most people won’t but it is a good idea.

..

Did you have more than one job during the year? Do you have a W2 from EACH of your jobs? You must report your total income from all taxable sources. What can you do if you don’t have this required for filing form?

..

If you have not received your W2 by February 14th, you can call the IRS for assistance. When you dial 1-800-829-1040, be prepared to wait on hold. It could be a long wait. This is a toll-free number and they get a lot of callers.

The assistor at the Internal Revenue Service will ask you for your name, your address with zip code and your social security number. (Remember YOU called them. DO NOT (and I MEAN EVER!) give this confidential information to any one who calls you. Protect your identity.) The IRS will also ask for your employer’s name, complete address, phone number and your dates of employment. IRS will contact your employer for you (if that is possible) and will request the missing form for you.

Form 4852, Substitute for W2, was designed for just this purpose. When you call the IRS to request their help, they will send you this form. There are blanks for

you to fill in your wages and withholdings. It will ask you how you determined the amounts you are entering. It will also ask you to describe what you did to try to obtain your W2.

If you did receive a W2, was it correct? If you think it was not correct, contact your employer and request a corrected one, a W2-C. If you filed your tax return using Form 4852 and then received a W2 or W2-C showing different amounts, then you must file Form 1040X to amend your return. This amendment may result in you owing more tax or it may result in you getting a refund. Consult your tax professional for help filing this more complicated form.

Well, these answers about our newest tax law change are direct from the horse’s mouth, the IRS.

“The following questions and answers provide information to individuals of the same sex and opposite sex who are in registered domestic partnerships, civil unions or other similar formal relationships that are not marriages under state law. These individuals are not considered as married or spouses for federal tax purposes. For convenience, these individuals are referred to as “registered domestic partners” in these questions and answers.

Answers to Some of the Frequently Asked Questions for Registered Domestic Partners and Individuals in Civil Unions”

“Can registered domestic partners file federal tax returns using a married filing jointly or married filing separately status?

Well, these answers about our newest tax law change are direct from the horse’s mouth, the IRS.

“The following questions and answers provide information to individuals of the same sex and opposite sex who are in registered domestic partnerships, civil unions or other similar formal relationships that are not marriages under state law. These individuals are not considered as married or spouses for federal tax purposes. For convenience, these individuals are referred to as “registered domestic partners” in these questions and answers.

Answers to Some of the Frequently Asked Questions for Registered Domestic Partners and Individuals in Civil Unions”

“Can registered domestic partners file federal tax returns using a married filing jointly or married filing separately status?

How can you play to win if you don’t know the rules? I have always focused on how to do things correctly. I want to know the rules of the games I play so I can play to win. And that’s what I want to give you, also.

When I was in law enforcement, I learned that there are some people who will never want to knowingly break the law. There are others who want to know what they can do to bend the rules. They don’t really want to break the law, but they don’t want to follow the straight and narrow path, either. And there are others who might have cared at one time, but don’t care anymore and they just want what they want. They care about themselves. They don’t think of anyone else involved.

The Internal Revenue Service is often in the news. But usually that news is to tell us, the tax-paying public, the changes in the tax law. Tax season is the time when the IRS wants to spotlight public figures who have done something wrong tax-wise. They get mileage out of these stories in trying to help the law-bending public understand the penalty of breaking the tax laws.

Tax season is never over. But today it is after April 15th. And the IRS is in the news again. This time IRS is the one in the spotlight. Somebody done somebody else wrong. We are being told that the IRS targeted specific groups. They did what some police people are accused of doing. They used profiling. They were on the lookout for groups that appeared to be more conservative than others. IRS is accused of denying or delaying the applications of groups wanting tax-exempt status.

The first group I think of as tax-exempt is religious. Other tax-exempt groups include scientific, literary and other charitable organizations. There are hundreds of other tax-exempt groups. Like social groups and fraternal societies, veterans organizations, political organizations. Don’t forget homeowners associations.

I’m not here to defend the IRS. I am just sharing with you some of what I learned as their former employee. When I was an auditor-in-training I was learning the ropes of the job of income tax auditor. What was my job? How do I do it well? As an employee of the federal government I had an honorable job and I wanted to do it well. It was the auditor’s job to see that the law was properly applied.

Even then, the IRS wanted me to know the penalty for stepping over the line. They have their own internal affairs division. IRS wants their employees to do their job properly. And if an employee chooses to cross the line, there is a penalty to pay. In most jobs those penalties may include time off without pay, demotion to a lower pay grade position, and even dismissal. Heads will roll.

Why does it take so long to discover this bad news? It takes time for cream to rise and It takes time for dust to settle. Before any case can be brought to trial, first someone has to be found out. Then evidence must be collected. Only the TV crime show can solve a case in 60 minutes.

When this kind of bad news goes viral, we can be glad to know that the system does work. Yes, one bad apple will spoil the whole barrel. That apple is removed. The barrel gets washed out. We begin again.

The IRS is here to stay. They are not going away. I play by the rules. When the rules change, I have to change my game plan. I hope I can help you, too.

Always to your lowest legal tax,

Nellie T Williams, EA

How can you play to win if you don’t know the rules? I have always focused on how to do things correctly. I want to know the rules of the games I play so I can play to win. And that’s what I want to give you, also.

When I was in law enforcement, I learned that there are some people who will never want to knowingly break the law. There are others who want to know what they can do to bend the rules. They don’t really want to break the law, but they don’t want to follow the straight and narrow path, either. And there are others who might have cared at one time, but don’t care anymore and they just want what they want. They care about themselves. They don’t think of anyone else involved.

The Internal Revenue Service is often in the news. But usually that news is to tell us, the tax-paying public, the changes in the tax law. Tax season is the time when the IRS wants to spotlight public figures who have done something wrong tax-wise. They get mileage out of these stories in trying to help the law-bending public understand the penalty of breaking the tax laws.

Tax season is never over. But today it is after April 15th. And the IRS is in the news again. This time IRS is the one in the spotlight. Somebody done somebody else wrong. We are being told that the IRS targeted specific groups. They did what some police people are accused of doing. They used profiling. They were on the lookout for groups that appeared to be more conservative than others. IRS is accused of denying or delaying the applications of groups wanting tax-exempt status.

The first group I think of as tax-exempt is religious. Other tax-exempt groups include scientific, literary and other charitable organizations. There are hundreds of other tax-exempt groups. Like social groups and fraternal societies, veterans organizations, political organizations. Don’t forget homeowners associations.

I’m not here to defend the IRS. I am just sharing with you some of what I learned as their former employee. When I was an auditor-in-training I was learning the ropes of the job of income tax auditor. What was my job? How do I do it well? As an employee of the federal government I had an honorable job and I wanted to do it well. It was the auditor’s job to see that the law was properly applied.

Even then, the IRS wanted me to know the penalty for stepping over the line. They have their own internal affairs division. IRS wants their employees to do their job properly. And if an employee chooses to cross the line, there is a penalty to pay. In most jobs those penalties may include time off without pay, demotion to a lower pay grade position, and even dismissal. Heads will roll.

Why does it take so long to discover this bad news? It takes time for cream to rise and It takes time for dust to settle. Before any case can be brought to trial, first someone has to be found out. Then evidence must be collected. Only the TV crime show can solve a case in 60 minutes.

When this kind of bad news goes viral, we can be glad to know that the system does work. Yes, one bad apple will spoil the whole barrel. That apple is removed. The barrel gets washed out. We begin again.

The IRS is here to stay. They are not going away. I play by the rules. When the rules change, I have to change my game plan. I hope I can help you, too.

Always to your lowest legal tax,

Nellie T Williams, EA