We have just passed the October 15th extended deadline to file your income tax return. If you are an individual taxpayer, your next deadline might be the 4th Quarter Estimated Tax Payment which is due before January 15th for the calendar year ending December 31st.

..

This can be confusing to a lot of my clients. If you think the January payment is for the current year, you are mistaken. It is for the PRIOR year. Since I work with these overlapping dates more often than you do, I have learned how to keep them straight. But if yours is the only tax return you are responsible for, these dates are often confusing.

..

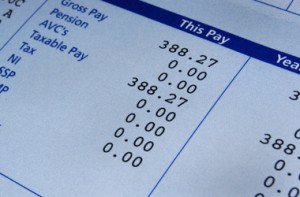

Who pays an estimated tax payment? Most wage earners get a paycheck. The money you take home is your “net check” after deductions are taken out. The basic deductions from most paychecks are for social security. medicare, federal and state income taxes.

..

You may have income on which there is no withholding. What kinds of income might that be? Interest and dividend income, rental property profits, sales of assets, gambling winnings, spousal maintenance (otherwise known as alimony) just to name a few.

..

Remember, as an American you are taxed on your worldwide income and every dollar is taxable unless it is specifically excluded. Some of the income that is not taxable includes child support, some inheritances and gifts you receive. There could be others, but I try to keep the length of these blogposts or articles to a pleasantly readable size.

..

So, back to estimated tax payments. They are designed to help you pay the tax you estimate you may be liable for. The Internal Revenue Services wants you to pay this tax money evenly throughout the tax year. Taxes withheld from your paycheck are considered paid evenly through the year, even if they fluctuate from payday to payday.

..

Small business owners generally do not take a paycheck. They figure their profits and make estimated tax payments to cover their income tax and their social security tax. Their tax for the year is figured when the tax return is completed.

..

Estimated Tax Payments are made in four payments on Form 1040ES. The first quarter is composed of months January, February and March. The first quarter (Q1)1040ES is due April 15th. The second quarter (Q2) is for months April and May (only two months here). Q2 1040ES is due June 15th. The third quarter is back to three months, June, July and August. with the Q3 1040ES payment due September 15th. And the fourth quarter, Q4, is the FOUR months of September, October, November and December. The 1040ES for Q4 is due January 15th of the following year. You just tell me how much you paid and when.

..

It is okay to make these estimated tax payments early. If you make the payments late, the late payment penalty is figured when preparing your 1040 tax return. If you did miss a payment this year, don’t panic. Just be prepared to add a few extra dollars (depending on the amount of your estimated tax payment) to your tax bill when your tax return is prepared.

We have just passed the October 15th extended deadline to file your income tax return. If you are an individual taxpayer, your next deadline might be the 4th Quarter Estimated Tax Payment which is due before January 15th for the calendar year ending December 31st.

..

This can be confusing to a lot of my clients. If you think the January payment is for the current year, you are mistaken. It is for the PRIOR year. Since I work with these overlapping dates more often than you do, I have learned how to keep them straight. But if yours is the only tax return you are responsible for, these dates are often confusing.

..

Who pays an estimated tax payment? Most wage earners get a paycheck. The money you take home is your “net check” after deductions are taken out. The basic deductions from most paychecks are for social security. medicare, federal and state income taxes.

..

You may have income on which there is no withholding. What kinds of income might that be? Interest and dividend income, rental property profits, sales of assets, gambling winnings, spousal maintenance (otherwise known as alimony) just to name a few.

..

Remember, as an American you are taxed on your worldwide income and every dollar is taxable unless it is specifically excluded. Some of the income that is not taxable includes child support, some inheritances and gifts you receive. There could be others, but I try to keep the length of these blogposts or articles to a pleasantly readable size.

..

So, back to estimated tax payments. They are designed to help you pay the tax you estimate you may be liable for. The Internal Revenue Services wants you to pay this tax money evenly throughout the tax year. Taxes withheld from your paycheck are considered paid evenly through the year, even if they fluctuate from payday to payday.

..

Small business owners generally do not take a paycheck. They figure their profits and make estimated tax payments to cover their income tax and their social security tax. Their tax for the year is figured when the tax return is completed.

..

Estimated Tax Payments are made in four payments on Form 1040ES. The first quarter is composed of months January, February and March. The first quarter (Q1)1040ES is due April 15th. The second quarter (Q2) is for months April and May (only two months here). Q2 1040ES is due June 15th. The third quarter is back to three months, June, July and August. with the Q3 1040ES payment due September 15th. And the fourth quarter, Q4, is the FOUR months of September, October, November and December. The 1040ES for Q4 is due January 15th of the following year. You just tell me how much you paid and when.

..

It is okay to make these estimated tax payments early. If you make the payments late, the late payment penalty is figured when preparing your 1040 tax return. If you did miss a payment this year, don’t panic. Just be prepared to add a few extra dollars (depending on the amount of your estimated tax payment) to your tax bill when your tax return is prepared.

0