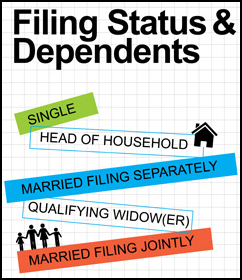

Did you know you are born with an income tax return filing status?

We all start off life as

Single. Even if you are a twin, you are a

Single taxpayer. Can a baby be a taxpayer? Did you ever hear of the Gerber Baby? The answer is “Yes.” And as an American citizen, your taxable income includes your WORLDWIDE income.

Your filing status is determined by your marital status on the last day of the calendar year. When you marry, and are married as of December 31st, you will generally choose

Married Filing Jointly. Now your taxable income includes the worldwide income of both husband and wife.

One of my clients asked, you mean if I get married on December 31st, I am treated as I was married ALL YEAR? And the answer to that question is YES. Maybe you want to marry on December 31st, but wait until after midnight to say “I DO!” and sign the license on January 1st. With planning you can choose the year you begin your joint return.

One thing I want you all to know: “Marry the man (or the woman) and you marry their tax troubles, too.” So be sure you know all the facts and enter into this new partnership, this new joint venture, with your eyes open.

Maybe you are part of an alternative lifestyle – part of a committed couple. Registered Domestic Partners of same-sex couples may have special choices for their state’s return, but not for the federal return.

The Internal Revenue Service will still expect a separate income tax return for each of you.

Some couples resist government intrusion into their personal lives and choose not to obtain the required state license to become married in the eyes of the law. They just share their love and share their lives. This is not a forum for the discussion of common law marriage (which is governed by your state), but the married filing status is reserved to the lawfully wedded couple.

Sometimes there is trouble in paradise. Couples separate. When a married couple is still married, but living apart, they may choose

Married Filing Jointly OR

Married Filing Separately. If you are legally separated, have a court-issued order of separation, but are still talking to each other, you may be better off tax-wise to continue to share information and file a joint return.

If you do choose

Married Filing Separately, or are forced into

Married Filing Separately because your spouse is not available to (or refuses to) sign a joint tax return, you will lose some of the tax benefits available on a joint return. Some of those many lost benefits include, among others, some tax credits and some education deductions. If one spouse itemizes, the other spouse MUST itemize and

cannot claim the standard deduction. If you are receiving Social Security benefits, a larger percentage of those benefits may be income taxable. There are also adjustments to capital losses, passive losses, sale of residence exclusion, and others. IRA contributions and deductions can also be affected. I recommend you consult a tax professional so if you do have a choice, you can make an informed decision.

If the formerly happy couple turns to divorce, the divorce decree will state in writing the agreements made by the divorcing couple. When I review a divorce decree I look to see if alimony or spousal support has been awarded. The spouse who pays alimony may deduct it. The spouse who receives alimony must include it in their taxable income.

I will also look to see how any children of this marriage will be treated for tax purposes. You have to understand that the IRS is not a party to this divorce. Even though the divorce decree may specify who is to claim a particular child as a dependent, there is a specific form that MUST BE part of your tax return to protect your income tax return. Form 8332 is used by the custodial parent to release the exemption to the non-custodial parent. There are so many different rules that must be addressed here, that I will save them for another blog post.

If you are a parent and there is at least one qualifying dependent residing in your home, you may qualify to file

Head of Household. If you are still married, one spouse may be

Married Filing Separately and the other spouse may be

Head of Household IF they did not live together the last six months of the year. If you are divorced it may be easier to determine your filing status.

The last filing status is

Qualifying Widow or Widower. Qualifying means there are rules to follow. Of course! We are talking

INCOME TAX CODE! If your spouse died within the past two years, you were entitled to file a joint return in the year of your spouse’s death, you did not remarry, and you have a dependent child or stepchild (not foster child) living with you the entire year, you may qualify as widow(er).

Have you heard, “Things Change.”? How many times was Elizabeth Taylor married? Like Liz, you may find yourself returning to

Single when the other filing status no longer apply to you.

It’s all about saving you money!

To your lowest legal tax,

Nellie Williams, EA

Bullet Proof Your Taxes

Did you ever play the game “telephone” as a child? Do you know you might still play it today? I’m not talking about gossip. I’m talking about misunderstanding.

One person hears something and shares it with someone else. That person shares what they think they heard and by the time you get to the end of the “line” the last story bears no resemblance to the original story.

Jumping to Conclusions

I know people who get their best exercise jumping to conclusions. Successful sales people lead their prospect to a buying conclusion. Why do I say this? Because I find that I am just as guilty as the rest of the mice following the Pied Piper out of Dublin. What does this mean? I “reported” that the winner of the last biggest Powerball multi-sate lottery had purchased the ticket in Arizona, but lived in Maryland, not Arizona.

I had seen with my own eyes on local television news a jubilant man jumping up and down in a convenience store in Maryland. We all thought HE was the big winner. He might have been “A” winner. But the “TRUE” big winner really was from Fountain Hills, Arizona. He lived just miles from where that winning ticket had been purchased.

In Arizona the winner’s last name and city of residence must be made public. This winner did the wise thing. He laid low for a few days. He consulted with his attorney. He consulted with his financial advisor. He made smart plans for his financial future. And THEN he came forward to claim his prize.

Enter Due Diligence

In my profession I must use “due diligence” in making my determinations. I must do the absolute best to apply the tax laws properly. I am all about helping you pay your lowest legal tax and not a penny more. And I rely on you to help me help you. If a client tells me something that does not add up, I have to research. I have to ask questions. I do a pretty good job of that. But in the case of this Powerball story I fell into the popular view promoted by the news. I take this as a personal reminder to watch myself.

The rest of that story was sound. I did the Sergeant Joe Friday thing and stuck to the facts, just the facts. Please use these tax-fact filled blogs to help yourselves learn the rules so you can play this tax game to win!

As always, to your lowest legal tax,

Nellie Williams, EA

Did you ever play the game “telephone” as a child? Do you know you might still play it today? I’m not talking about gossip. I’m talking about misunderstanding.

One person hears something and shares it with someone else. That person shares what they think they heard and by the time you get to the end of the “line” the last story bears no resemblance to the original story.

Jumping to Conclusions

I know people who get their best exercise jumping to conclusions. Successful sales people lead their prospect to a buying conclusion. Why do I say this? Because I find that I am just as guilty as the rest of the mice following the Pied Piper out of Dublin. What does this mean? I “reported” that the winner of the last biggest Powerball multi-sate lottery had purchased the ticket in Arizona, but lived in Maryland, not Arizona.

I had seen with my own eyes on local television news a jubilant man jumping up and down in a convenience store in Maryland. We all thought HE was the big winner. He might have been “A” winner. But the “TRUE” big winner really was from Fountain Hills, Arizona. He lived just miles from where that winning ticket had been purchased.

In Arizona the winner’s last name and city of residence must be made public. This winner did the wise thing. He laid low for a few days. He consulted with his attorney. He consulted with his financial advisor. He made smart plans for his financial future. And THEN he came forward to claim his prize.

Enter Due Diligence

In my profession I must use “due diligence” in making my determinations. I must do the absolute best to apply the tax laws properly. I am all about helping you pay your lowest legal tax and not a penny more. And I rely on you to help me help you. If a client tells me something that does not add up, I have to research. I have to ask questions. I do a pretty good job of that. But in the case of this Powerball story I fell into the popular view promoted by the news. I take this as a personal reminder to watch myself.

The rest of that story was sound. I did the Sergeant Joe Friday thing and stuck to the facts, just the facts. Please use these tax-fact filled blogs to help yourselves learn the rules so you can play this tax game to win!

As always, to your lowest legal tax,

Nellie Williams, EA  Did you ever play the game “telephone” as a child? Do you know you might still play it today? I’m not talking about gossip. I’m talking about misunderstanding.

One person hears something and shares it with someone else. That person shares what they think they heard and by the time you get to the end of the “line” the last story bears no resemblance to the original story.

Jumping to Conclusions

I know people who get their best exercise jumping to conclusions. Successful sales people lead their prospect to a buying conclusion. Why do I say this? Because I find that I am just as guilty as the rest of the mice following the Pied Piper out of Dublin. What does this mean? I “reported” that the winner of the last biggest Powerball multi-sate lottery had purchased the ticket in Arizona, but lived in Maryland, not Arizona.

I had seen with my own eyes on local television news a jubilant man jumping up and down in a convenience store in Maryland. We all thought HE was the big winner. He might have been “A” winner. But the “TRUE” big winner really was from Fountain Hills, Arizona. He lived just miles from where that winning ticket had been purchased.

In Arizona the winner’s last name and city of residence must be made public. This winner did the wise thing. He laid low for a few days. He consulted with his attorney. He consulted with his financial advisor. He made smart plans for his financial future. And THEN he came forward to claim his prize.

Enter Due Diligence

In my profession I must use “due diligence” in making my determinations. I must do the absolute best to apply the tax laws properly. I am all about helping you pay your lowest legal tax and not a penny more. And I rely on you to help me help you. If a client tells me something that does not add up, I have to research. I have to ask questions. I do a pretty good job of that. But in the case of this Powerball story I fell into the popular view promoted by the news. I take this as a personal reminder to watch myself.

The rest of that story was sound. I did the Sergeant Joe Friday thing and stuck to the facts, just the facts. Please use these tax-fact filled blogs to help yourselves learn the rules so you can play this tax game to win!

As always, to your lowest legal tax,

Nellie Williams, EA

Did you ever play the game “telephone” as a child? Do you know you might still play it today? I’m not talking about gossip. I’m talking about misunderstanding.

One person hears something and shares it with someone else. That person shares what they think they heard and by the time you get to the end of the “line” the last story bears no resemblance to the original story.

Jumping to Conclusions

I know people who get their best exercise jumping to conclusions. Successful sales people lead their prospect to a buying conclusion. Why do I say this? Because I find that I am just as guilty as the rest of the mice following the Pied Piper out of Dublin. What does this mean? I “reported” that the winner of the last biggest Powerball multi-sate lottery had purchased the ticket in Arizona, but lived in Maryland, not Arizona.

I had seen with my own eyes on local television news a jubilant man jumping up and down in a convenience store in Maryland. We all thought HE was the big winner. He might have been “A” winner. But the “TRUE” big winner really was from Fountain Hills, Arizona. He lived just miles from where that winning ticket had been purchased.

In Arizona the winner’s last name and city of residence must be made public. This winner did the wise thing. He laid low for a few days. He consulted with his attorney. He consulted with his financial advisor. He made smart plans for his financial future. And THEN he came forward to claim his prize.

Enter Due Diligence

In my profession I must use “due diligence” in making my determinations. I must do the absolute best to apply the tax laws properly. I am all about helping you pay your lowest legal tax and not a penny more. And I rely on you to help me help you. If a client tells me something that does not add up, I have to research. I have to ask questions. I do a pretty good job of that. But in the case of this Powerball story I fell into the popular view promoted by the news. I take this as a personal reminder to watch myself.

The rest of that story was sound. I did the Sergeant Joe Friday thing and stuck to the facts, just the facts. Please use these tax-fact filled blogs to help yourselves learn the rules so you can play this tax game to win!

As always, to your lowest legal tax,

Nellie Williams, EA

I am a baby boomer. I remember my dad building our “secret” bomb shelter in our basement during the Cuban missile crisis. There were six of us in the family. And this was meant to protect US only. It was a matter of life and death. We did have canned food, paper plates, paper towels, toilet paper, diapers for the new baby, a change of clothes for everyone, some games and books to keep us busy, candles, matches, batteries, first aid kit and a bottle of liquor for medicinal purposes only. Thinking back, we probably would not have survived in that little basement hide-away.

But what am I talking about today? What is an evacuation box. In a time of looming disaster you may be forced to leave your home or business for some undetermined period of time. You leave your place. You leave your stuff.

What can you do NOW to protect yourself and your family? Imagine having only five minutes to get what you need. What can you take with you? Do you know what you should take? Do you know where it is? Can you get it all in those fleeting five minutes?

I extend my sincere sympathies to people right now suffering and facing current losses. There are no words to comfort you. For the rest of you, if you want to protect yourself and your family, create your own Evacuation Box right away.

What is an Evacuation Box?

It is like having your own personal insurance for your essential documents. This box has to be something you can easily take with you. It can be a briefcase. It can be a white box. You don’t want it to be accidentally thrown away! I think if I am ever going to have to carry this, I’d rather it be a backpack so I can have my arms and hands free. Whatever you choose, it must safeguard your most important and often irreplaceable documents.

What goes into your Evacuation Box?

Just think about some of the essential documents you have collected over your lifetime. Birth certificate. Social Security card. Health insurance card. Medical records. School records and college transcripts. Driver’s license. Car titles. Boat registrations. Library card. Marriage certificate. Passport. Visa. Immigration documents. Deed to your house. Mortgage to your house.

Who so you still owe? What are those loan numbers? Include a list of your doctor’s names and current prescriptions. (And tuck in that favorite photo of your loved ones if you have room.)

Make a copy of BOTH sides of your credit cards. When one card expires, make a copy of the new one. Make a list of your utility providers, their names and your account numbers. Make a copy of your insurance policies, at least the page with your policy number and coverage details. Record the Vehicle Identification Numbers (VIN) for your cars, trucks, boats, etc. Have duplicates made of your keys, all of them, for your vehicles, homes, safety deposit boxes. etc.

Photograph your home, it’s contents. Make as detailed an inventory as possible. Keep it updated as you add things or remove things. Inventory the contents of your vehicles. Estimate the age and value of each item on your list. Consider using a computer and software for this. Keep a print out as well as a flash drive of these files.

Make a copy of the original documents. Include a copy of your most recent tax return. That’s always a good starting point for your next return. Put the duplicate copies in your evacuation box. Safeguard your original documents in your safety deposit box at the bank, or in a fireproof safe permanently secured in your home.

Where are you going to keep this Evacuation Box?

Do not keep this box in your car. Keep it near a doorway until any evacuation is ordered. If you go on vacation or away from your home for any period of time, take this box to a trusted relative or friend.

When are you going to make this Evacuation Box?

The sooner the better. Don’t you want insurance before your need it? Some of these documents are irreplaceable. Those that can be replaced take time. And if a lot of people are making the same request for replacements at the same time, you might have to wait longer than you want to for your copy. Do this now while it is less difficult to accomplish. You never know when disaster might strike.

When are you going to use this Evacuation Box?

I hope you never need this box. But if you do, I hope you make this box soon. You need it ready for that in-a-moment’s notice.

Always to your lowest tax,

Nellie T Williams, EA

I am a baby boomer. I remember my dad building our “secret” bomb shelter in our basement during the Cuban missile crisis. There were six of us in the family. And this was meant to protect US only. It was a matter of life and death. We did have canned food, paper plates, paper towels, toilet paper, diapers for the new baby, a change of clothes for everyone, some games and books to keep us busy, candles, matches, batteries, first aid kit and a bottle of liquor for medicinal purposes only. Thinking back, we probably would not have survived in that little basement hide-away.

But what am I talking about today? What is an evacuation box. In a time of looming disaster you may be forced to leave your home or business for some undetermined period of time. You leave your place. You leave your stuff.

What can you do NOW to protect yourself and your family? Imagine having only five minutes to get what you need. What can you take with you? Do you know what you should take? Do you know where it is? Can you get it all in those fleeting five minutes?

I extend my sincere sympathies to people right now suffering and facing current losses. There are no words to comfort you. For the rest of you, if you want to protect yourself and your family, create your own Evacuation Box right away.

What is an Evacuation Box?

It is like having your own personal insurance for your essential documents. This box has to be something you can easily take with you. It can be a briefcase. It can be a white box. You don’t want it to be accidentally thrown away! I think if I am ever going to have to carry this, I’d rather it be a backpack so I can have my arms and hands free. Whatever you choose, it must safeguard your most important and often irreplaceable documents.

What goes into your Evacuation Box?

Just think about some of the essential documents you have collected over your lifetime. Birth certificate. Social Security card. Health insurance card. Medical records. School records and college transcripts. Driver’s license. Car titles. Boat registrations. Library card. Marriage certificate. Passport. Visa. Immigration documents. Deed to your house. Mortgage to your house.

Who so you still owe? What are those loan numbers? Include a list of your doctor’s names and current prescriptions. (And tuck in that favorite photo of your loved ones if you have room.)

Make a copy of BOTH sides of your credit cards. When one card expires, make a copy of the new one. Make a list of your utility providers, their names and your account numbers. Make a copy of your insurance policies, at least the page with your policy number and coverage details. Record the Vehicle Identification Numbers (VIN) for your cars, trucks, boats, etc. Have duplicates made of your keys, all of them, for your vehicles, homes, safety deposit boxes. etc.

Photograph your home, it’s contents. Make as detailed an inventory as possible. Keep it updated as you add things or remove things. Inventory the contents of your vehicles. Estimate the age and value of each item on your list. Consider using a computer and software for this. Keep a print out as well as a flash drive of these files.

Make a copy of the original documents. Include a copy of your most recent tax return. That’s always a good starting point for your next return. Put the duplicate copies in your evacuation box. Safeguard your original documents in your safety deposit box at the bank, or in a fireproof safe permanently secured in your home.

Where are you going to keep this Evacuation Box?

Do not keep this box in your car. Keep it near a doorway until any evacuation is ordered. If you go on vacation or away from your home for any period of time, take this box to a trusted relative or friend.

When are you going to make this Evacuation Box?

The sooner the better. Don’t you want insurance before your need it? Some of these documents are irreplaceable. Those that can be replaced take time. And if a lot of people are making the same request for replacements at the same time, you might have to wait longer than you want to for your copy. Do this now while it is less difficult to accomplish. You never know when disaster might strike.

When are you going to use this Evacuation Box?

I hope you never need this box. But if you do, I hope you make this box soon. You need it ready for that in-a-moment’s notice.

Always to your lowest tax,

Nellie T Williams, EA  Are you an employer? Are you and employee? I own my own business. I am both. I wear both hats.

Recently I spoke with a client who also is an employer. He has employees. And he has a problem with one of his employees.

I have learned so much over my varied career. I want to share with you what I’ve learned to help you have a better workplace. Now I don’t have all the answers. No one does. But see if you experienced any of what I experienced.

Are you an employer? Are you and employee? I own my own business. I am both. I wear both hats.

Recently I spoke with a client who also is an employer. He has employees. And he has a problem with one of his employees.

I have learned so much over my varied career. I want to share with you what I’ve learned to help you have a better workplace. Now I don’t have all the answers. No one does. But see if you experienced any of what I experienced.

Tick, Tock, Tick, Tock!

Have I ever told you about the time line that the INTERNAL REVENUE SERVICE is bound by? There are due dates. There are many of them.

Most of us are calendar-year taxpayers. That means our tax year ends December 31st. And when we file an individual income tax return, a Form 1040, that is due April 15th of the following year. At one time the 1040 was due March 15th, but so many people asked for extra time the due date was changed to April 15th. Even today, many people still ask for extensions. Not too long ago the extension gave us two additional months to file the return. And so many people asked for a second 4-month extension that the 2nd extension was eliminated and IRS now gives us one six-month extension. This means that if you REQUEST an extension of time, your April 15th due date has been extended to October 15th.

An extension of time only gives us time to file the paperwork. It does not give us any more time to pay our tax. The tax is still due by April 15th. If on April 15th you think you will owe tax with your tax return, you can make a payment with your extension and still get more time to finish your paperwork to file a correct and accurate tax return. If you wind up owing tax when you file that extended return, the extension will not be valid. Interest will be charged from April 15th until your taxes are paid in full. Penalties will also be assessed for late-filing and for late-paying your tax. This is not a pretty picture.

If you have a business and file a corporate return, whether it be a “C” Corporation or an “S” Corporation you may have a calendar-year entity or a fiscal year entity. Both “C” and “S” corporations have income and expenses. They have Income Statements and Balance Sheets. They have Schedules of Depreciation for assets like equipment and buildings. A “C” Corporation files an 1120 return, can have a tax liability on income greater than expenses, and the corporation would pay that tax. If you elect for that corporation to be treated as a small or “S” corporation, it files an 1120S return instead and the income greater than expenses, or profit, passes through to the shareholder (or shareholders) on form K1. The shareholder includes their share of the corporate profits on their 1040 tax return along with their other income. To keep it simple, if the corporation uses a calendar year, then that corporate return is due March 15th. And, like a personal 1040 return, can elect a 6-month extension that for the corporation ends September 15th.

Whether business or individual, you must request an extension. They are not automatic. And they are only good for filing the paperwork, the tax returns.. Any taxes due must be paid by the due date to avoid interest and penalties.

Have you ever heard the expression, “The shoemaker’s son goes barefoot.”? Lots of times I feel like the shoemaker’s son. My own tax returns are always on extension. Could I file them early and avoid the rush? Sure, but what would be the fun in that? I must really love the adrenaline rush. I am all about time management. But last week was truly “Just in Time! Management.” Did you ever stay up late studying for an exam? Did you ever pull an “all-nighter” where you didn’t get any sleep at all? I did. I did in college and I did last week, too. In some ways I am a lot like some of my own clients. I was busy finishing clients’ business returns and getting ready for an out-of-town business trip, and I found myself staying up all night to file my own business return before leaving for the airport for my business trip. tick, tock, tick, tock….

If you miss the extension deadline that return is just flat out delinquent. And I cannot be late and stay in business for you! So I missed a little sleep.

It is still September. But October is right around the corner! Like many of you, I, too, must finish my personal 1040 return before October 15th. Even though we have a deadline to meet, I encourage you to take the time you need to do a good job of getting your figures together. It is so much better and easier to file correctly to begin with. Remember, you are signing under penalty of perjury that you are filing a correct and accurate return.

If you do later find you need to amend a tax return, there’s a form for that. And the 1040X Amended Return has its due date too. Often you may file what you think is an accurate return only to get an additional form that you forgot about or didn’t even know you should have waited for. This often happens when you are the heir of someone who has passed away and you inherit something taxable. In that instance you will owe tax with that amended return. It is so much better to file that amendment than to wait for the IRS to tell you about your additional income and tax due. If you wait too long to file on your own, the IRS will start that ball rolling.

Maybe you find you left something off that is to your benefit, that would lower the tax you already paid, that would generate a refund for you. Here is where the timing is really important. You only have so much time to file that request for refund. Generally you must file the 1040X within three years of the date you filed that original return. This due date can be tricky, so be sure to consult your professional for advice on your 1040X.

Well, back to extended 1040s due October 15th. Since you and I will be getting our 2011 tax return information in order, may I suggest it is also a good time to start organizing our 2012 (this year we are in) data? Do you hear it? tick, tock, tick, tock …

To our lowest legal tax,

Nellie Williams, EA

Tick, Tock, Tick, Tock!

Have I ever told you about the time line that the INTERNAL REVENUE SERVICE is bound by? There are due dates. There are many of them.

Most of us are calendar-year taxpayers. That means our tax year ends December 31st. And when we file an individual income tax return, a Form 1040, that is due April 15th of the following year. At one time the 1040 was due March 15th, but so many people asked for extra time the due date was changed to April 15th. Even today, many people still ask for extensions. Not too long ago the extension gave us two additional months to file the return. And so many people asked for a second 4-month extension that the 2nd extension was eliminated and IRS now gives us one six-month extension. This means that if you REQUEST an extension of time, your April 15th due date has been extended to October 15th.

An extension of time only gives us time to file the paperwork. It does not give us any more time to pay our tax. The tax is still due by April 15th. If on April 15th you think you will owe tax with your tax return, you can make a payment with your extension and still get more time to finish your paperwork to file a correct and accurate tax return. If you wind up owing tax when you file that extended return, the extension will not be valid. Interest will be charged from April 15th until your taxes are paid in full. Penalties will also be assessed for late-filing and for late-paying your tax. This is not a pretty picture.

If you have a business and file a corporate return, whether it be a “C” Corporation or an “S” Corporation you may have a calendar-year entity or a fiscal year entity. Both “C” and “S” corporations have income and expenses. They have Income Statements and Balance Sheets. They have Schedules of Depreciation for assets like equipment and buildings. A “C” Corporation files an 1120 return, can have a tax liability on income greater than expenses, and the corporation would pay that tax. If you elect for that corporation to be treated as a small or “S” corporation, it files an 1120S return instead and the income greater than expenses, or profit, passes through to the shareholder (or shareholders) on form K1. The shareholder includes their share of the corporate profits on their 1040 tax return along with their other income. To keep it simple, if the corporation uses a calendar year, then that corporate return is due March 15th. And, like a personal 1040 return, can elect a 6-month extension that for the corporation ends September 15th.

Whether business or individual, you must request an extension. They are not automatic. And they are only good for filing the paperwork, the tax returns.. Any taxes due must be paid by the due date to avoid interest and penalties.

Have you ever heard the expression, “The shoemaker’s son goes barefoot.”? Lots of times I feel like the shoemaker’s son. My own tax returns are always on extension. Could I file them early and avoid the rush? Sure, but what would be the fun in that? I must really love the adrenaline rush. I am all about time management. But last week was truly “Just in Time! Management.” Did you ever stay up late studying for an exam? Did you ever pull an “all-nighter” where you didn’t get any sleep at all? I did. I did in college and I did last week, too. In some ways I am a lot like some of my own clients. I was busy finishing clients’ business returns and getting ready for an out-of-town business trip, and I found myself staying up all night to file my own business return before leaving for the airport for my business trip. tick, tock, tick, tock….

If you miss the extension deadline that return is just flat out delinquent. And I cannot be late and stay in business for you! So I missed a little sleep.

It is still September. But October is right around the corner! Like many of you, I, too, must finish my personal 1040 return before October 15th. Even though we have a deadline to meet, I encourage you to take the time you need to do a good job of getting your figures together. It is so much better and easier to file correctly to begin with. Remember, you are signing under penalty of perjury that you are filing a correct and accurate return.

If you do later find you need to amend a tax return, there’s a form for that. And the 1040X Amended Return has its due date too. Often you may file what you think is an accurate return only to get an additional form that you forgot about or didn’t even know you should have waited for. This often happens when you are the heir of someone who has passed away and you inherit something taxable. In that instance you will owe tax with that amended return. It is so much better to file that amendment than to wait for the IRS to tell you about your additional income and tax due. If you wait too long to file on your own, the IRS will start that ball rolling.

Maybe you find you left something off that is to your benefit, that would lower the tax you already paid, that would generate a refund for you. Here is where the timing is really important. You only have so much time to file that request for refund. Generally you must file the 1040X within three years of the date you filed that original return. This due date can be tricky, so be sure to consult your professional for advice on your 1040X.

Well, back to extended 1040s due October 15th. Since you and I will be getting our 2011 tax return information in order, may I suggest it is also a good time to start organizing our 2012 (this year we are in) data? Do you hear it? tick, tock, tick, tock …

To our lowest legal tax,

Nellie Williams, EA

Oh, no. I owe!

I owe the IRS. What do I do now? Is there any hope for me?

Will I go to jail? Will I lose my house? Will they take my car? Will they take my retirement account? What can they do to me?

Oh, no. I owe!

I owe the IRS. What do I do now? Is there any hope for me?

Will I go to jail? Will I lose my house? Will they take my car? Will they take my retirement account? What can they do to me?

Benjamin Franklin said, the only guarantees in life are Death and Taxes.

Do I have to pay taxes after I die? I thought taxes would end when I did!

While we are earning money, we get a W2 or a 1099 and we pay INCOME TAX.

When we have investments that pay us interest income or dividend income or we sell an investment for a profit and have a capital gain we pay INCOME TAX.

When we are retired and receiving retirement benefits we may pay INCOME TAX.

And now you tell me I might have to pay taxes even after I die? If you leave too much money behind when you leave this earth, you may be subject to ESTATE TAX.

Benjamin Franklin said, the only guarantees in life are Death and Taxes.

Do I have to pay taxes after I die? I thought taxes would end when I did!

While we are earning money, we get a W2 or a 1099 and we pay INCOME TAX.

When we have investments that pay us interest income or dividend income or we sell an investment for a profit and have a capital gain we pay INCOME TAX.

When we are retired and receiving retirement benefits we may pay INCOME TAX.

And now you tell me I might have to pay taxes even after I die? If you leave too much money behind when you leave this earth, you may be subject to ESTATE TAX.

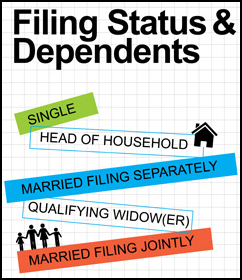

Did you know you are born with an income tax return filing status?

We all start off life as Single. Even if you are a twin, you are a Single taxpayer. Can a baby be a taxpayer? Did you ever hear of the Gerber Baby? The answer is “Yes.” And as an American citizen, your taxable income includes your WORLDWIDE income.

Your filing status is determined by your marital status on the last day of the calendar year. When you marry, and are married as of December 31st, you will generally choose Married Filing Jointly. Now your taxable income includes the worldwide income of both husband and wife.

One of my clients asked, you mean if I get married on December 31st, I am treated as I was married ALL YEAR? And the answer to that question is YES. Maybe you want to marry on December 31st, but wait until after midnight to say “I DO!” and sign the license on January 1st. With planning you can choose the year you begin your joint return.

One thing I want you all to know: “Marry the man (or the woman) and you marry their tax troubles, too.” So be sure you know all the facts and enter into this new partnership, this new joint venture, with your eyes open.

Maybe you are part of an alternative lifestyle – part of a committed couple. Registered Domestic Partners of same-sex couples may have special choices for their state’s return, but not for the federal return. The Internal Revenue Service will still expect a separate income tax return for each of you.

Some couples resist government intrusion into their personal lives and choose not to obtain the required state license to become married in the eyes of the law. They just share their love and share their lives. This is not a forum for the discussion of common law marriage (which is governed by your state), but the married filing status is reserved to the lawfully wedded couple.

Sometimes there is trouble in paradise. Couples separate. When a married couple is still married, but living apart, they may choose Married Filing Jointly OR Married Filing Separately. If you are legally separated, have a court-issued order of separation, but are still talking to each other, you may be better off tax-wise to continue to share information and file a joint return.

If you do choose Married Filing Separately, or are forced into Married Filing Separately because your spouse is not available to (or refuses to) sign a joint tax return, you will lose some of the tax benefits available on a joint return. Some of those many lost benefits include, among others, some tax credits and some education deductions. If one spouse itemizes, the other spouse MUST itemize and

Did you know you are born with an income tax return filing status?

We all start off life as Single. Even if you are a twin, you are a Single taxpayer. Can a baby be a taxpayer? Did you ever hear of the Gerber Baby? The answer is “Yes.” And as an American citizen, your taxable income includes your WORLDWIDE income.

Your filing status is determined by your marital status on the last day of the calendar year. When you marry, and are married as of December 31st, you will generally choose Married Filing Jointly. Now your taxable income includes the worldwide income of both husband and wife.

One of my clients asked, you mean if I get married on December 31st, I am treated as I was married ALL YEAR? And the answer to that question is YES. Maybe you want to marry on December 31st, but wait until after midnight to say “I DO!” and sign the license on January 1st. With planning you can choose the year you begin your joint return.

One thing I want you all to know: “Marry the man (or the woman) and you marry their tax troubles, too.” So be sure you know all the facts and enter into this new partnership, this new joint venture, with your eyes open.

Maybe you are part of an alternative lifestyle – part of a committed couple. Registered Domestic Partners of same-sex couples may have special choices for their state’s return, but not for the federal return. The Internal Revenue Service will still expect a separate income tax return for each of you.

Some couples resist government intrusion into their personal lives and choose not to obtain the required state license to become married in the eyes of the law. They just share their love and share their lives. This is not a forum for the discussion of common law marriage (which is governed by your state), but the married filing status is reserved to the lawfully wedded couple.

Sometimes there is trouble in paradise. Couples separate. When a married couple is still married, but living apart, they may choose Married Filing Jointly OR Married Filing Separately. If you are legally separated, have a court-issued order of separation, but are still talking to each other, you may be better off tax-wise to continue to share information and file a joint return.

If you do choose Married Filing Separately, or are forced into Married Filing Separately because your spouse is not available to (or refuses to) sign a joint tax return, you will lose some of the tax benefits available on a joint return. Some of those many lost benefits include, among others, some tax credits and some education deductions. If one spouse itemizes, the other spouse MUST itemize and  Did you know the Internal Revenue Service has a name for taxpayers who do not file their required income tax returns? Is that you? Do you owe the IRS a tax return? Are you a NON-FILER?

If you file your individual income tax return on or before April 15th (the usual due date for 1040 tax returns) then you have filed TIMELY. If you file a special form you can REQUEST an automatic extension. But you must ask for this extension. And when you ask for the extension you will automatically be given an additional 6 months to file the paperwork. This extension does not give you more time to pay your tax. If you owe the IRS money, you want to pay that before April 15th to avoid penalties and interest. There are a lot of rules about paying your tax, but that is a topic for another blog.

If you have a Partnership, the due date for the Form 1065 is also April 15th. If you have a corporation, that calendar-year C or S corporate return is due on or before March 15th. Partnerships and Corporations can also request an extension that will allow them up to September 15th to file their returns. If you have a business, maybe you missed filing a quarterly employment tax return.

It is perfectly acceptable to file your returns on extension. Sometimes your circumstances will dictate you file an extension. Sometimes you make the choice to file an extension. But the key word here is FILE or submit the tax return. If you have a requirement to file and you do not file that return, you are a Non-Filer. And by putting yourself in the position of Non-Filer, you are also putting yourself in position to attract special attention of the Internal Revenue Service. This special attention is not quite a

Did you know the Internal Revenue Service has a name for taxpayers who do not file their required income tax returns? Is that you? Do you owe the IRS a tax return? Are you a NON-FILER?

If you file your individual income tax return on or before April 15th (the usual due date for 1040 tax returns) then you have filed TIMELY. If you file a special form you can REQUEST an automatic extension. But you must ask for this extension. And when you ask for the extension you will automatically be given an additional 6 months to file the paperwork. This extension does not give you more time to pay your tax. If you owe the IRS money, you want to pay that before April 15th to avoid penalties and interest. There are a lot of rules about paying your tax, but that is a topic for another blog.

If you have a Partnership, the due date for the Form 1065 is also April 15th. If you have a corporation, that calendar-year C or S corporate return is due on or before March 15th. Partnerships and Corporations can also request an extension that will allow them up to September 15th to file their returns. If you have a business, maybe you missed filing a quarterly employment tax return.

It is perfectly acceptable to file your returns on extension. Sometimes your circumstances will dictate you file an extension. Sometimes you make the choice to file an extension. But the key word here is FILE or submit the tax return. If you have a requirement to file and you do not file that return, you are a Non-Filer. And by putting yourself in the position of Non-Filer, you are also putting yourself in position to attract special attention of the Internal Revenue Service. This special attention is not quite a  W-2G is used to report Gambling Winnings. There are different reporting requirements depending on the type of game you won. If you were the WINNER you may or may not be ahead “of the game.” To avoid an IRS inquiry, report ALL gambling winnings, whether or not you received a W2G.

You may be the luckiest person in the world. But did you know your winnings are taxable? Do you keep a record of your gambling activity? Did you know you are required to keep a log of your activity to document your gambling losses if you itemize your deductions and want to deduct those losses?

It doesn’t have to be the end of the world to keep that

W-2G is used to report Gambling Winnings. There are different reporting requirements depending on the type of game you won. If you were the WINNER you may or may not be ahead “of the game.” To avoid an IRS inquiry, report ALL gambling winnings, whether or not you received a W2G.

You may be the luckiest person in the world. But did you know your winnings are taxable? Do you keep a record of your gambling activity? Did you know you are required to keep a log of your activity to document your gambling losses if you itemize your deductions and want to deduct those losses?

It doesn’t have to be the end of the world to keep that