November is National Peanut Butter Lover’s Month. I grew up on peanut butter and jelly sandwiches. I still have one of these comfort, stand-by sandwiches every once in a while. And I love peanut butter cookies!

..

Can you deduct peanut butter? Not if it is just your own, or your children’s meal. And chances are you’re not going to offer a peanut butter sandwich to your business client. But you could decide to serve a fancied up sandwich at a business get-together. Think about a working lunch or a special afternoon tea type theme to your business meeting.

..

If you run a sandwich shop, peanut butter can be an ingredient in one of your menu items. If you run a daycare center, you will certainly be serving this staple at lunch. Cookies can become a business gift. And maybe you want to have your clients over for an afternoon celebration. Of course, if your guest list includes someone with a peanut allergy, peanut butter will not be on the menu. But then this peanut butter could be the cause of a medical deduction. So there can be several ways peanut butter and taxes really are related.

..

The IRS loves the words “ordinary and necessary”, “generally” and “usually”. To be deductible your meal or entertainment expense must be “directly related to” or “associated with” the active conduct of a trade or business. It can also be for the production or collection of income. It cannot be lavish or extravagant. It must be reasonable considering the facts and circumstances.

..

Do you remember the five Ws of journalism?

Who, what, when, where, why and then add

how much you spent.. Who did you entertain? What did your discuss. When did you have this meal? Where did you go? What was the business purpose or what did you want to talk about at this restaurant? And how much did you spend? Your deduction can include the cost of the food, beverage and tip, but is limited to 50%. The cost of your own meal at a restaurant is not deductible. Meals with coworkers or business associates are not deductible unless you can show a clear business purpose.

..

You must show that the main purpose for this meal or entertainment was for business; that you engaged in business during this meal or activity. You must also have more than a general expectation of receiving income or some other specific business benefit in the future.

..

Instead of “directly related”, where you discuss business over a meal, your business discussion can be “associated with” the meal or entertainment. How much talking could possibly go on during a concert, at the theater or at a rousing sporting event or a backyard bar-b-que? If you are entertaining at your home,

be sure to have a guest book for your records. Have each of your guests sign in.

..

If the business discussion or transaction is substantial (and directly before or after the meal or entertainment) it can be deductible. There is no requirement that you spend more time on business than on the meal or entertainment.

..

Employers have exceptions to the 50% deduction limit. If you provide meals to more than half of your employees on your business premises and for your convenience (not the convenience of the employee), those meals are a 100% deductible fringe benefit. Employer provided social or recreational expenses, like a company party or picnic, for the benefit of employees who are not highly compensated employees, are 100% deductible.

..

I can’t emphasize enough your need to keep adequate records. This is for your tax audit protection.

How to Easily keep Tax Records for as long as you need them. And be ready anytime for the Inquiring Mind of the IRS.

The IRS has more than one employee. They have more than one division. Do they have more than one mind? They do have one mission. The mission of the Examination Division is to determine if the correct amount of tax was paid.

When it comes to your tax returns, IRS has certain requirements.

My Top 5 Tips are simple. Here is a recap of the 5 tips I gave you in my last blog of 2014.

How to Easily keep Tax Records for as long as you need them. And be ready anytime for the Inquiring Mind of the IRS.

The IRS has more than one employee. They have more than one division. Do they have more than one mind? They do have one mission. The mission of the Examination Division is to determine if the correct amount of tax was paid.

When it comes to your tax returns, IRS has certain requirements.

My Top 5 Tips are simple. Here is a recap of the 5 tips I gave you in my last blog of 2014.

Attention Employees: This is the blog I promised you.

Attention Employees: This is the blog I promised you.

We have just celebrated the end of the “1040 Marathon”. But that does not mean that income tax season is over. Have you filed your return or are you “on extension?” Or maybe you are just going to file your tax return later this year.

This blog is “a day late and a dollar short” for filing 2012 tax returns. But it is right on time for 2013 tax planning!

Even if you are afraid you will owe tax, I do recommend you file your return before April 15th. Especially if you are going to owe tax. When you owe more than $1000 when you file your return, the Internal Revenue Service will assess you a late-filing penalty of 5% per month. That’s 5% of the tax due. The only good news about this is that the maximum penalty is 25%. Well, 25% of $1000 is $250. PLUS the IRS must charge you interest on top of the penalty.

If you think you are going to owe tax and you request an extension of time to file, pay some money with that extension to keep that extension valid. If you don’t pay your tax by April 15th, the IRS must assess that late penalty.

Here’s a tip you can start using right away. If you are self-employed it is up to you to estimate your taxes. You make quarterly estimated tax payments. If you don’t pay enough, and you don’t pay enough on the date the quarterly estimated tax payments are due, you can be assessed a late-payment penalty. This is different from the late-filing penalty I talked about earlier.

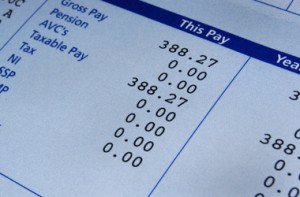

If you are an employee, you should have taxes withheld from your paycheck. That income tax withholding is considered paid evenly throughout the year. If you have more withheld in November and December than in the earlier months, your total withholding for the year is still considered paid evenly all through the year.

You can adjust your withholding any time during the year. Does your payroll department restrict how many times they will adjust your paycheck? Just be careful that if you are not taking enough out in the first part of the year, that you don’t run out of paychecks before the end of the year. You want to have enough withheld to make your total enough to cover your tax bill on April 15th. Once January comes around you are already into the next year.

You may have other income that is taxable, like interest or dividends, rental income or sale of property. You might want to or need to make estimated tax payments. Estimated tax payments are due April 15th, June 15th, September 15th and January 15th. If you want more information on how to estimate your taxes, shoot me an email.

Remember this. Failing to plan is planning to fail. Nobody ever PLANS to pay more than they have to. So keep you eyes open on your own tax situation to keep the IRS out of your wallet.

Always to your lowest legal tax,

Nellie T Williams, EA

We have just celebrated the end of the “1040 Marathon”. But that does not mean that income tax season is over. Have you filed your return or are you “on extension?” Or maybe you are just going to file your tax return later this year.

This blog is “a day late and a dollar short” for filing 2012 tax returns. But it is right on time for 2013 tax planning!

Even if you are afraid you will owe tax, I do recommend you file your return before April 15th. Especially if you are going to owe tax. When you owe more than $1000 when you file your return, the Internal Revenue Service will assess you a late-filing penalty of 5% per month. That’s 5% of the tax due. The only good news about this is that the maximum penalty is 25%. Well, 25% of $1000 is $250. PLUS the IRS must charge you interest on top of the penalty.

If you think you are going to owe tax and you request an extension of time to file, pay some money with that extension to keep that extension valid. If you don’t pay your tax by April 15th, the IRS must assess that late penalty.

Here’s a tip you can start using right away. If you are self-employed it is up to you to estimate your taxes. You make quarterly estimated tax payments. If you don’t pay enough, and you don’t pay enough on the date the quarterly estimated tax payments are due, you can be assessed a late-payment penalty. This is different from the late-filing penalty I talked about earlier.

If you are an employee, you should have taxes withheld from your paycheck. That income tax withholding is considered paid evenly throughout the year. If you have more withheld in November and December than in the earlier months, your total withholding for the year is still considered paid evenly all through the year.

You can adjust your withholding any time during the year. Does your payroll department restrict how many times they will adjust your paycheck? Just be careful that if you are not taking enough out in the first part of the year, that you don’t run out of paychecks before the end of the year. You want to have enough withheld to make your total enough to cover your tax bill on April 15th. Once January comes around you are already into the next year.

You may have other income that is taxable, like interest or dividends, rental income or sale of property. You might want to or need to make estimated tax payments. Estimated tax payments are due April 15th, June 15th, September 15th and January 15th. If you want more information on how to estimate your taxes, shoot me an email.

Remember this. Failing to plan is planning to fail. Nobody ever PLANS to pay more than they have to. So keep you eyes open on your own tax situation to keep the IRS out of your wallet.

Always to your lowest legal tax,

Nellie T Williams, EA