Do you have employees? Did you pay them during April, May or June? If yes, then you have payroll reports due for the 2nd quarter of this calendar year.

sssss

What if you didn’t pay any employees during April, May or June? If you have been filing these quarterly reports and did not tell the Internal Revenue Service that you stopped having employees, you have to file these reports for the second quarter, too. You will just report zero wages and zero withholdings.

sssss

There is nothing simple about the IRS. There is a little wrinkle here for some employers. If you have been given permission to file an annual 944 instead of the quarterly 941, you may just have quarterly state reports to file.

sssss

But for most of us, you now know July 31st is the due date for Q2 (second quarter) payroll reports. Not just the reports, but the payments due with them, also.

sssss

It is easier for some people to work with numbers. I am a number cruncher. I prepare reports for my own company and I prepare reports for several business clients. All my payroll clients have to do is tell me the details.

sssss

The details are not difficult. they give me a list of employees with their names, addresses and social security numbers. MAJOR TIP: Never write anyone any paycheck until you have this information AND you have their completed form I-9.

sssss

For every paydate, I need the following information. 1) the name of the employee, 2) the amount of the check, 3) the amounts withheld and for what.

sssss

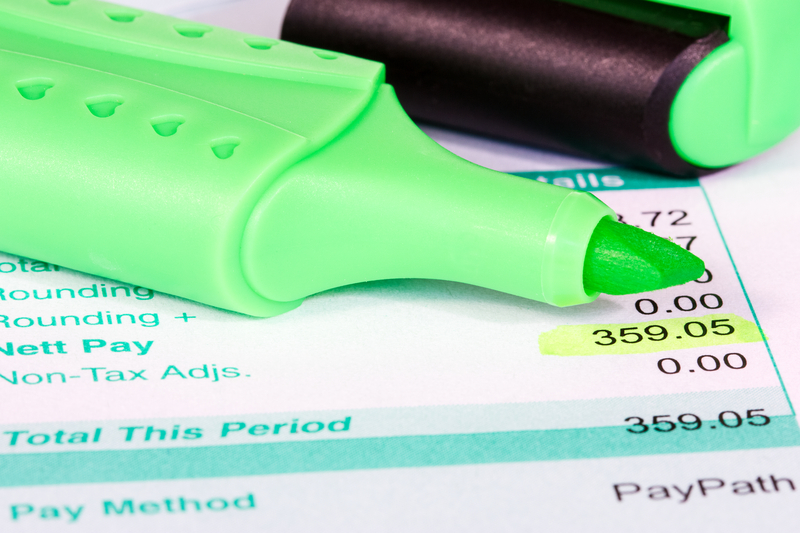

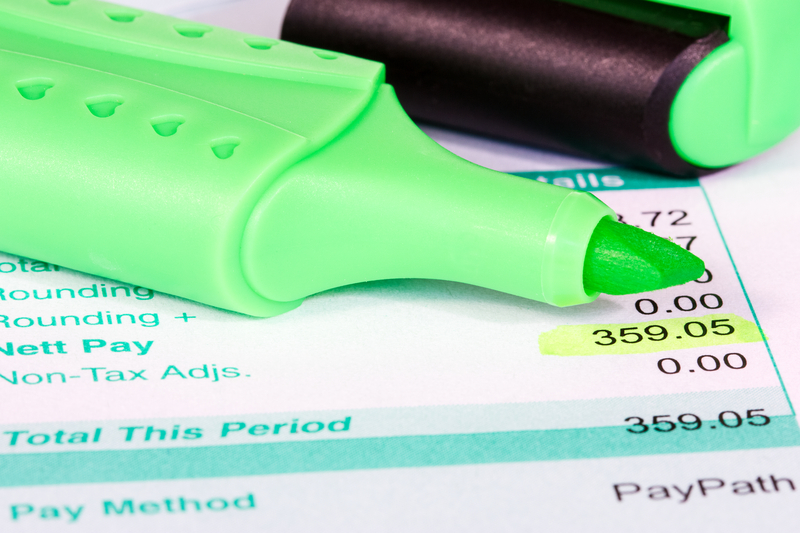

The amount you wrote the check for is called the “net” check. “Net” take-home pay is AFTER deductions. The amount of the paycheck BEFORE deductions is called “gross” paycheck. I need to know how much you withheld for each of the taxes your employee may be subject to.

sssss

Taxes must be withheld from each employee’s paycheck. These taxes start with the employee’s one-half of social security and medicare taxes. Based on the employees gross check they may also have federal income taxes withheld. And if you pay workers who live in a state that has stare income tax, you may also be withholding state income taxes.

sssss

You may have other employee benefits that the employee pays for out of his check. An example of this could be the tools a mechanic buys for his job that he pays for out of his paycheck. This deduction does not change what he makes, but it does change what he takes home.

sssss

When it comes to social security and medicare taxes, the employee is only responsible to pay half. YOU, the employer, pay the other half of these two taxes. If you fail to withhold these taxes from your employee’s pay, you are responsible to pay the WHOLE amount. You can wind up paying both halves when you don’t withhold from the employee.

sssss

You, the employer, are also responsible for paying federal unemployment taxes. You may send a payment every quarter, but this report is not due until the end of the year. Your state, however, may have a report and payment due each quarter.

sssss

What’s next? File your reports and pay the taxes due for Q2 before July 31st to avoid penalties and interest for late filing and/or late payment.

For those that can file the simplest of tax forms, you may have your W2 and are ready to file. Last week I talked about W2, W2-G, 1099-G, 1099-Misc and K1 forms. Today I talk about more of the common forms you need to complete your proper tax form.

1099-R is used to report distributions paid to you from your pension plan, your retirement plan or our Individual Retirement Account or IRA. If you have a distribution that is not taxable, it must still be taken into account in filing your proper tax return.

1099-INT is sent to you when you earn $10 or more interest on a bank account or certificate of deposit. You should get one of these forms for each account that

generated $10 or more of interest. If you have more than one account at a single branch, they may report each account separately on a single, or consolidated, statement. Some banks show each account and provide the total earnings for all accounts. Whether or not you withdrew the interest, or had it in your hot little hands, this is taxable income that must be reported. If you earned less than $10 you are still required to report the interest earned, you just won’t get the Form 1099-INT to remind you. In this case, you’ll need to check your account statement that includes December 31st.

1099-DIV reports to you earnings of $10 or more in dividends paid on stocks, bonds and mutual funds. Like 1099-INT, you are responsible to report all earnings even if you had less that $10 and do not get this form. 1099-DIV also includes capital gains paid on these investments. These capital gains are for activity within you account, not for the sales of stocks from your account. Both ordinary dividend and capital gain dividend numbers are important in calculating your proper tax. Your tax professional will see that you don’t overpay your tax. 1099-B reports your sale of stocks, bonds or mutual funds. You receive Form 1099-B from your broker or mutual fund company. This form can be one page or multiple pages depending on the size of your account. For each sale this report will tell you the name of the stock or fund account, how many shares were sold, the date of the sale and the sales price. Some brokers issue a preliminary report to meet heir February 15th deadline to issue this Form 1099-B, but they will tell you to expect a corrected or final statement later in the tax season. Provide EVERY page of this report to your tax advisor.

1099-C reports Cancellation of Debt income which must be reported on your tax return. This income may or may not be taxable to you. It can be issued because you were unable to pay a debt, perhaps credit card or mortgage debt. Be sure to share this information with your trusted tax advisor. The US Tax Code states all income is reportable except that which is specifically exempt from tax. Protect yourself from IRS audit by reporting all of your income.

For those that can file the simplest of tax forms, you may have your W2 and are ready to file. Last week I talked about W2, W2-G, 1099-G, 1099-Misc and K1 forms. Today I talk about more of the common forms you need to complete your proper tax form.

1099-R is used to report distributions paid to you from your pension plan, your retirement plan or our Individual Retirement Account or IRA. If you have a distribution that is not taxable, it must still be taken into account in filing your proper tax return.

1099-INT is sent to you when you earn $10 or more interest on a bank account or certificate of deposit. You should get one of these forms for each account that

generated $10 or more of interest. If you have more than one account at a single branch, they may report each account separately on a single, or consolidated, statement. Some banks show each account and provide the total earnings for all accounts. Whether or not you withdrew the interest, or had it in your hot little hands, this is taxable income that must be reported. If you earned less than $10 you are still required to report the interest earned, you just won’t get the Form 1099-INT to remind you. In this case, you’ll need to check your account statement that includes December 31st.

1099-DIV reports to you earnings of $10 or more in dividends paid on stocks, bonds and mutual funds. Like 1099-INT, you are responsible to report all earnings even if you had less that $10 and do not get this form. 1099-DIV also includes capital gains paid on these investments. These capital gains are for activity within you account, not for the sales of stocks from your account. Both ordinary dividend and capital gain dividend numbers are important in calculating your proper tax. Your tax professional will see that you don’t overpay your tax. 1099-B reports your sale of stocks, bonds or mutual funds. You receive Form 1099-B from your broker or mutual fund company. This form can be one page or multiple pages depending on the size of your account. For each sale this report will tell you the name of the stock or fund account, how many shares were sold, the date of the sale and the sales price. Some brokers issue a preliminary report to meet heir February 15th deadline to issue this Form 1099-B, but they will tell you to expect a corrected or final statement later in the tax season. Provide EVERY page of this report to your tax advisor.

1099-C reports Cancellation of Debt income which must be reported on your tax return. This income may or may not be taxable to you. It can be issued because you were unable to pay a debt, perhaps credit card or mortgage debt. Be sure to share this information with your trusted tax advisor. The US Tax Code states all income is reportable except that which is specifically exempt from tax. Protect yourself from IRS audit by reporting all of your income.  For those that can file the simplest of tax forms, you may have your W2 and are ready to file. Last week I talked about W2, W2-G, 1099-G, 1099-Misc and K1 forms. Today I talk about more of the common forms you need to complete your proper tax form.

1099-R is used to report distributions paid to you from your pension plan, your retirement plan or our Individual Retirement Account or IRA. If you have a distribution that is not taxable, it must still be taken into account in filing your proper tax return.

1099-INT is sent to you when you earn $10 or more interest on a bank account or certificate of deposit. You should get one of these forms for each account that

generated $10 or more of interest. If you have more than one account at a single branch, they may report each account separately on a single, or consolidated, statement. Some banks show each account and provide the total earnings for all accounts. Whether or not you withdrew the interest, or had it in your hot little hands, this is taxable income that must be reported. If you earned less than $10 you are still required to report the interest earned, you just won’t get the Form 1099-INT to remind you. In this case, you’ll need to check your account statement that includes December 31st.

1099-DIV reports to you earnings of $10 or more in dividends paid on stocks, bonds and mutual funds. Like 1099-INT, you are responsible to report all earnings even if you had less that $10 and do not get this form. 1099-DIV also includes capital gains paid on these investments. These capital gains are for activity within you account, not for the sales of stocks from your account. Both ordinary dividend and capital gain dividend numbers are important in calculating your proper tax. Your tax professional will see that you don’t overpay your tax. 1099-B reports your sale of stocks, bonds or mutual funds. You receive Form 1099-B from your broker or mutual fund company. This form can be one page or multiple pages depending on the size of your account. For each sale this report will tell you the name of the stock or fund account, how many shares were sold, the date of the sale and the sales price. Some brokers issue a preliminary report to meet heir February 15th deadline to issue this Form 1099-B, but they will tell you to expect a corrected or final statement later in the tax season. Provide EVERY page of this report to your tax advisor.

1099-C reports Cancellation of Debt income which must be reported on your tax return. This income may or may not be taxable to you. It can be issued because you were unable to pay a debt, perhaps credit card or mortgage debt. Be sure to share this information with your trusted tax advisor. The US Tax Code states all income is reportable except that which is specifically exempt from tax. Protect yourself from IRS audit by reporting all of your income.

For those that can file the simplest of tax forms, you may have your W2 and are ready to file. Last week I talked about W2, W2-G, 1099-G, 1099-Misc and K1 forms. Today I talk about more of the common forms you need to complete your proper tax form.

1099-R is used to report distributions paid to you from your pension plan, your retirement plan or our Individual Retirement Account or IRA. If you have a distribution that is not taxable, it must still be taken into account in filing your proper tax return.

1099-INT is sent to you when you earn $10 or more interest on a bank account or certificate of deposit. You should get one of these forms for each account that

generated $10 or more of interest. If you have more than one account at a single branch, they may report each account separately on a single, or consolidated, statement. Some banks show each account and provide the total earnings for all accounts. Whether or not you withdrew the interest, or had it in your hot little hands, this is taxable income that must be reported. If you earned less than $10 you are still required to report the interest earned, you just won’t get the Form 1099-INT to remind you. In this case, you’ll need to check your account statement that includes December 31st.

1099-DIV reports to you earnings of $10 or more in dividends paid on stocks, bonds and mutual funds. Like 1099-INT, you are responsible to report all earnings even if you had less that $10 and do not get this form. 1099-DIV also includes capital gains paid on these investments. These capital gains are for activity within you account, not for the sales of stocks from your account. Both ordinary dividend and capital gain dividend numbers are important in calculating your proper tax. Your tax professional will see that you don’t overpay your tax. 1099-B reports your sale of stocks, bonds or mutual funds. You receive Form 1099-B from your broker or mutual fund company. This form can be one page or multiple pages depending on the size of your account. For each sale this report will tell you the name of the stock or fund account, how many shares were sold, the date of the sale and the sales price. Some brokers issue a preliminary report to meet heir February 15th deadline to issue this Form 1099-B, but they will tell you to expect a corrected or final statement later in the tax season. Provide EVERY page of this report to your tax advisor.

1099-C reports Cancellation of Debt income which must be reported on your tax return. This income may or may not be taxable to you. It can be issued because you were unable to pay a debt, perhaps credit card or mortgage debt. Be sure to share this information with your trusted tax advisor. The US Tax Code states all income is reportable except that which is specifically exempt from tax. Protect yourself from IRS audit by reporting all of your income.